Key Insights:

- 2024 Growth Cut: HSBC lowered luxury sector growth forecast to 2.8% from 5.5%, marking it the 6th-worst year in 20 years.

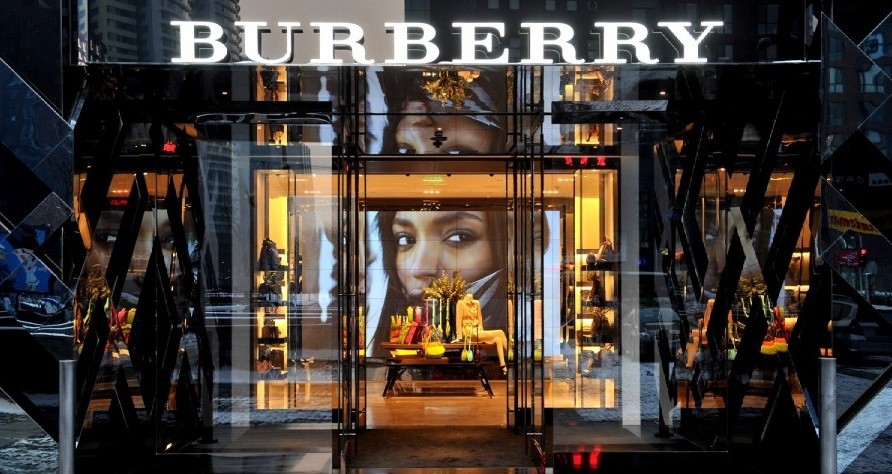

- Divergent Results: Prada is expected to grow 21% in Q3 2024, while Gucci and Burberry face declines of 18% and 10%.

- China & U.S. Slowdowns: Chinese consumers are holding back on spending, and U.S. buyers face inflation and high interest rates.

- European “Greedflation”: Price hikes post-COVID are causing cautious luxury spending among European consumers.

- 2025 Recovery: HSBC predicts 7% growth in 2025, with double-digit growth possible by Q2.

The global luxury goods market is on track for a tough year, as highlighted in HSBC Global Research’s recent report, titled “Cruel Summer.” The report revises the sector’s organic growth forecast for 2024 down to 2.8%, from an earlier projection of 5.5%. This downward revision stems from companies’ updated earnings estimates in late July, making 2024 the sixth-worst year for luxury in the past two decades.

Key players in the luxury industry, including Burberry, Hermès, Kering, LVMH, and Prada, have seen varying performances. While some brands like Hermès and Prada managed to maintain positive momentum in the first half of the year, with Prada retail expected to post a 21% growth in Q3, others like Gucci and Burberry are facing steep declines, with HSBC predicting a 10% drop for Burberry and an 18% decline for Gucci in Q3 2024.

The report attributes these struggles to several factors, notably decelerating consumer spending in key markets like China and the U.S. Chinese consumers, despite having strong savings, are holding back on discretionary purchases, while inflationary pressures and high interest rates have impacted U.S. shoppers, particularly in the aspirational segment. Europe presents a mixed scenario, with consumers demonstrating a “wait-and-see” attitude amid what analysts describe as “greedflation,” where luxury brands raised prices post-COVID beyond inflationary needs.

Japan, however, remains a bright spot in the sector, driven by robust tourism, particularly from China, other Asian countries, and the U.S.

Looking ahead, HSBC analysts expect luxury market growth to recover in 2025, forecasting a 7% increase, with high single-digit growth by Q1 2025 and potential double-digit growth in Q2, driven by a low comparison base from this year’s declines.